Tax Planning

I teach business owners and real estate investors how to legally reduce their tax bill.

By implementing effective tax-saving techniques I'll help you minimize their tax burden through strategic planning and a thorough understanding of tax laws and regulations.

How Can Tax Strategy Benefit You?

Personalized tax strategies help you reduce your taxes and minimize your tax burden. When you add all the tax regulations, and guidelines from the IRS there are about 75,000 pages in the Tax Code. When you look at it like that working with a tax professional who has a deep knowledge of tax laws who is commitment to client success, ensures you pay only what you owe and nothing more.

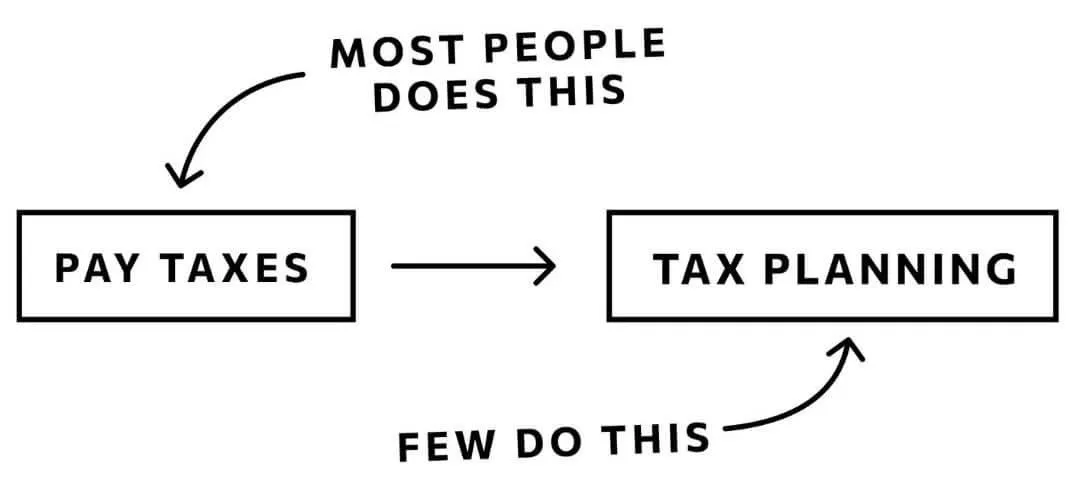

Proactive Tax Savings vs. Reactive Tax Preparation

Most people only think about taxes during filing season, but strategic tax planning can help you legally minimize your tax liability throughout the year. By working proactively, you can potentially save thousands of dollars that would otherwise go to the IRS.

Our tax strategy approach identifies opportunities for tax reduction before they disappear, turning taxes from a once-a-year headache into a continuous wealth optimization process.

Click here to book your Tax Assessement and get started.

"The avoidance of taxes is the only intellectual pursuit that still carries any reward."

- John Maynard Keynes

IS TAX STRATEGY RIGHT FOR YOU?

Get The Savvy Business Owner's Setup Guide:

Position Your Business Up for Success with

Tax Saving Strategies

Are you ready to build a rock-solid business foundation that will supercharge your growth and set you up for long-term success? This isn't just another generic business guide – it's your roadmap to creating a sustainable, thriving enterprise.

Inside you'll find easy to understand steps you can take to ensure your business is built on a solid foundation like:

Learn the best entity structure for your business to legally cut your tax bill.

The Do's and Don'ts of Business Expenses

Documentation Best Practices

90% of business owners overpay their taxes because they fail to write-off expenses they already pay for. But not you. With the Savvy Business Owner's Setup Guide you will be in the 10%.

Get In Touch

(404) 429-5477

Address: 1441 Woodmont Ln NW, #970, Atlanta GA 30318

Email: [email protected]

Assistance Hours :

Mon – Sat by Appointment Only